Tungsten bars face high supply risk

Hat tip to Money Morning Australia for drawing my attention to the British Geological Survey's supply risk index in an article about graphite. I wasn't interesting in the graphite story - my eye was immediately drawn to the #2 ranking of tungsten in the table below.

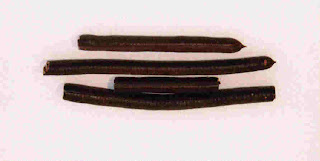

With gold becoming increasingly popular, risk of supply problems with the key input to fake gold bars I'm sure is a top concern for fraudsters around the world (and New York in particular). Let us also not forget central bankers, who we can be sure are also concerned about any potential restriction on their ability to make fake 400oz bars to replace all the real gold that has been leased/sold.

Interestingly, the BGS note that "84% of the world's tungsten is currently sourced from China", with China also being the top reserve holder of tungsten as well. So not only is the US exposed to China holding all its debt, it is also at their mercy as to fake tungsten bar supply.

While I'm being silly, it seems appropriate to discuss the silver:gold ratio. This topic attracts a lot of stupidity along the lines of "the silver:gold ratio should be X because of Y and therefore silver is going to the moon". Often the "because of Y" uses some sort of supply metric or that some King thousands of years ago set the ratio at 10:1. Curiously, the so derived ratio is always lower than the current ratio.

One of the BGS' criteria for determining supply risk is Scarcity and they provide a handy table of each elements global scarcity. Silver is 0.055 parts per million while gold is 0.0013ppm. Hmm, that is a ratio of 42.3:1.

Anyway, this whole line of argument is shortsighted to start with as scarcity is not the only driver of price, as something can be really scarce but if no one wants it, it ain't worth anything - as Kid Dynamite covered in this post.

Comments

Post a Comment